Full text: Report on China's central, local budgets(2013)

BEIJING -- Following is the full text of report on the implementation of central and local budgets in 2012 and on draft central and local budgets for 2013, which was submitted for review on March 5, 2013 at the first annual session of the 12th National People's Congress and was adopted on March 17:

REPORT ON THE IMPLEMENTATION OF CENTRAL AND LOCAL BUDGETS IN 2012 AND ON DRAFT CENTRAL AND LOCAL BUDGETS FOR 2013

First Session of the Twelfth National People's Congress

March 5, 2013

Ministry of Finance of the People's Republic of China

Fellow Deputies,

The Ministry of Finance has been entrusted by the State Council to submit this report on the implementation of the central and local budgets in 2012 and on the draft central and local budgets for 2013 to the First Session of the Twelfth National People's Congress (NPC) for your deliberation and approval and for comments and suggestions from members of the National Committee of the Chinese People's Political Consultative Conference (CPPCC).

I. Implementation of Central and Local Budgets in 2012

In 2012, under the firm leadership of the Communist Party of China (CPC), the people of all the country's ethnic groups worked tenaciously and forged ahead in solidarity, and progress was achieved in economic and social development while ensuring stability. On the basis of this, fresh headway was made in fiscal development and reforms, and government budgets were satisfactorily implemented.

1. Implementation of Public Finance Budgets

National revenue totaled 11.720975 trillion yuan, an increase of 12.8% over 2011 (here and below). Adding the 270 billion yuan from the central budget stabilization fund, utilized revenue totaled 11.990975 trillion yuan. National expenditure amounted to 12.571225 trillion yuan, up 15.1%. Adding the 18.415 billion yuan of central government surplus revenue used to replenish the central budget stabilization fund, the 200 billion yuan used to repay the principal on local government bonds and the 1.335 billion yuan of local government expenditure carried forward to 2013, national expenditure totaled 12.790975 trillion yuan. Total national expenditure therefore exceeded total national revenue by 800 billion yuan.

Breaking these figures down, central government revenue amounted to 5.613242 trillion yuan, 100.4% of the budgeted figure and an increase of 9.4%. Including the 270 billion yuan contributed by the central budget stabilization fund, total revenue used by the central government came to 5.883242 trillion yuan. Central government expenditure amounted to 6.414827 trillion yuan, 100% of the budgeted figure and an increase of 13.7%. This consists of 1.87648 trillion yuan of central government spending, up 13.6%, and 4.538347 trillion yuan in tax rebates and transfer payments to local governments, an increase of 13.7%. Adding the 18.415 billion yuan of central government surplus revenue used to replenish the central budget stabilization fund, central government expenditure totaled 6.433242 trillion yuan. Total expenditure of the central government exceeded total revenue, leaving a deficit of 550 billion yuan, the same as the budgeted figure. The outstanding balance on government bonds in the central budget was 7.75657 trillion yuan at the end of 2012, which was under the budgeted limit of 8.270835 trillion yuan for the year.

Graphics shows the balance of Chinese central government finances in 2012, according to the report on the implementation of central and local budgets in 2012 and on draft central and local budgets for 2013, which was submitted for review on March 5, 2013 at the first annual session of the 12th National People's Congress and was adopted on March 17.(Xinhua/Gao Wei)

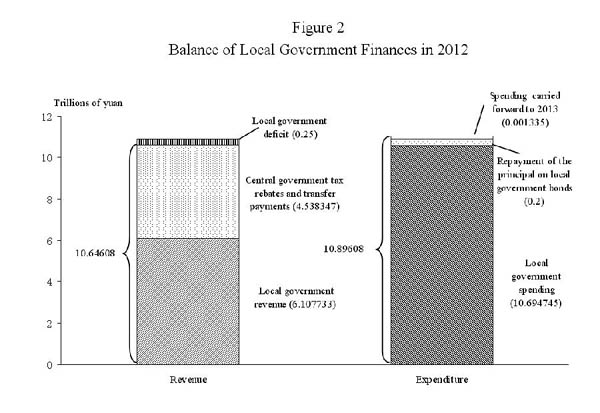

The revenue of local governments came to 6.107733 trillion yuan, an increase of 16.2%. Adding the 4.538347 trillion yuan in tax rebates and transfer payments from the central government, local government revenue totaled 10.64608 trillion yuan. Local government expenditure amounted to 10.694745 trillion yuan, up 15.3%. Adding the 200 billion yuan used to repay the principal on local government bonds and the 1.335 billion yuan carried forward to 2013, local government expenditure totaled 10.89608 trillion yuan. Total expenditure by local governments exceeded total revenue by 250 billion yuan.

Graphics shows the balance of local government finances of China in 2012, according to the report on the implementation of central and local budgets in 2012 and on draft central and local budgets for 2013, which was submitted for review on March 5, 2013 at the first annual session of the 12th National People's Congress and was adopted on March 17.(Xinhua/Gao Wei)

The following is a breakdown of main items in the central budget in 2012:

1) Main revenue items

Domestic VAT revenue was 1.967847 trillion yuan, 97.2% of the budgeted figure. This shortfall was mainly due to small increases in the value-added of industry and the CPI. Domestic excise tax revenue was 787.214 billion yuan, 102.2% of the budgeted figure; revenue from VAT and excise tax on imports amounted to 1.479641 trillion yuan, 99.7% of the budgeted figure; and revenue from customs duties came to 278.274 billion yuan, 103.4% of the budgeted figure. Corporate income tax revenue was 1.208218 trillion yuan, 108.7% of the budgeted figure. It exceeded the budgeted figure largely because actual corporate income tax revenue for 2011 exceeded estimates on which tax was collected that year, with the remainder paid in 2012. Individual income tax revenue was 349.261 billion yuan, 102.7% of the budgeted figure; VAT and excise tax rebates on exports came to 1.042888 trillion yuan, 104.8% of the budgeted figure; and non-tax receipts totaled 284.878 billion yuan, 100.8% of the budgeted figure.

Central government revenue exceeded the budgeted figure by 21.242 billion yuan in 2012. Of this, 2.827 billion yuan from surplus vehicle purchase tax revenue was used to increase spending on highway construction as required by relevant regulations, and the remaining 18.415 billion yuan was used to replenish the central budget stabilization fund for future budgetary purposes.

2) Main expenditure items

In line with the requirements of ensuring steady economic growth, adjusting the economic structure, promoting reform, and improving quality of life, and based on the need for economic and social development, we adjusted the structure of expenditures during budget implementation and focused on increasing investment in areas related to improving quality of life, such as government-subsidized housing, agriculture, water conservancy, energy conservation, and environmental protection, all of which was achieved without exceeding the budget for central government expenditure (including central government spending and transfer payments to local governments).

Education spending reached 378.152 billion yuan, 100% of the budgeted figure and an increase of 15.7%. We provided funds to support the development of preschool education to ease the shortage of preschools. We refined the mechanism to ensure funding for rural compulsory education, helped to repair and upgrade more primary and secondary rural school buildings, and significantly raised subsidies to the central and western regions. We supported the implementation of a plan to improve the nutrition of over 30 million rural students in compulsory education. A total of 34.45 million urban compulsory education students were exempted from tuition and miscellaneous fees and compulsory education was provided to 12.6 million children of rural migrant workers living together in cities. Rural students, including those from counties and towns, and urban students who are studying agriculture-related majors or from poor families were exempted from secondary vocational school tuition fees. We improved the policy system for providing government financial aid to students from poor families, benefiting approximately 15.96 million students, and advanced Project 985 and Project 211, thereby improving college and university infrastructure and comprehensively raising the quality of higher education.

Combining all budgetary expenditures on education from central and local public finances and government-managed funds, total government education spending reached 2.1994 trillion yuan in 2012, or 4% of GDP.

Spending on science and technology came to 229.15 billion yuan, 100.3% of the budgeted figure and a 12.7% increase. Major state science and technology programs were effectively implemented, and we increased investment in the State Natural Sciences Fund and Program 973, thereby securing substantially more funding for key state laboratories and basic research institutes. Significant progress was made in promoting research on cutting-edge technologies and major generic key technologies, as well as research for public benefit. We vigorously supported construction of scientific and technological infrastructure, and promoted open sharing and highly efficient use of scientific and technological resources. We also funded the implementation of scientific and technological projects that benefit the people and encouraged the application of scientific and technological advances.

Expenditure on culture, sports, and media totaled 49.468 billion yuan, 100.2% of the budgeted figure and an increase of 18.9%. Funds were used to grant free admission to public cultural facilities, including 1,804 museums and memorial halls and over 40,000 galleries and libraries, and to make progress in the national cultural information resource sharing project, the rural library project, and other key cultural projects that benefit the people. Funding was provided to intensify protection of key national cultural artifacts, major cultural and historical sites, cultural resources that relate to the early history of the CPC, and intangible cultural heritage. The international broadcasting capabilities of key media were improved, and we supported efforts to take Chinese culture to a global audience and promoted the rapid development of the culture industry.

Spending on medical and health care amounted to 204.82 billion yuan, 100.6% of the budgeted figure and a 17.2% increase. We raised subsidies to the new rural cooperative medical care system and basic medical insurance for non-working urban residents from 200 yuan to 240 yuan per person per year and further raised the proportion of medical expenses that are reimbursable. We put in place a permanent mechanism for compensating community-level medical and health care institutions that implement the basic drug system, and introduced it in all village clinics. We supported trial reforms of public hospitals in 17 cities and 311 counties or county-level cities. We continued to implement basic and major public health service projects and increased medical assistance, thereby enabling more people to benefit to a greater extent.

Spending on social security and employment amounted to 575.373 billion yuan, 100.1% of the budgeted figure and an increase of 22%. We achieved full coverage of the new old-age pension system for the rural population and the old-age pension system for non-working urban residents. We raised basic pensions for enterprise retirees for the eighth consecutive year, with average monthly benefits reaching 1,721 yuan per person. We increased subsistence allowances for urban and rural residents living in areas that receive central government subsidies by an average of 15 yuan and 12 yuan respectively per person per month. We raised subsidies and living allowances for some entitled groups; improved the social assistance system targeted at orphans, people with disabilities, the homeless, and beggars; and increased efforts to help people affected by natural disasters to restore their lives. We improved policies and measures aimed at boosting employment and supported urban residents in finding jobs or starting their own businesses.

The appropriation for guaranteeing adequate housing was 260.16 billion yuan, up 44.6% and 122.9% of the budgeted figure. The main reason for going over the budgeted figure was an increase in subsidies for building government-subsidized housing and supporting infrastructure in urban areas as well as renovating dilapidated rural houses in the course of implementing the budget. Of the total appropriation, 225.389 billion yuan was spent on government-subsidized housing projects, including basically finishing the construction of 6.01 million units of urban housing and starting construction on another 7.81 million during the year. The project to renovate dilapidated rural houses was expanded from the central and western regions to rural areas throughout the country and central government subsidies were raised, which resulted in the renovation of 5.6 million homes in 2012.

Expenditure on agriculture, forestry, and water conservancy came to 599.598 billion yuan, 109.2% of the budgeted figure and a 25.3% gain. The main reason for exceeding the budget was an additional investment during implementation in efforts to provide relief from disasters that affect agricultural production, prevent and control serious floods and droughts, build major water conservancy projects as well as irrigation and water conservancy facilities, reinforce small dilapidated reservoirs, and clean up and improve the flood defenses of small and medium-sized rivers. We provided funding to step up agricultural and rural infrastructure development, move forward with the project to construct small irrigation and water conservancy facilities in 1,250 key counties, launch a campaign to save water and increase grain output, basically complete the work of reinforcing 7,000 small dilapidated reservoirs and cleaning up and improving the flood defenses of 27,500 kilometers of 2,209 small and medium-sized rivers, and support 958 counties in preventing and controlling mountain torrents. We increased subsidies for grain producers and extended the coverage of such policies. We expanded the areas and crop varieties eligible for agricultural insurance subsidies, thereby providing 900.6 billion yuan worth of risk protection to 183 million farming households. We supported the development of a modern seed industry and promoted the application of drought-resistant farming and arable land protection techniques. Last year, 2.002 million hectares of low- and medium-yield cropland was upgraded to high-yield standards, construction started or continued on 235 projects to upgrade water-saving equipment in medium-sized irrigated areas, 1.738 million hectares of irrigated land were created or improved, and the policy of subsidizing and rewarding grassland ecological conservation was expanded to cover all herding and semi-herding counties designated by the state. We increased investment in comprehensive poverty relief efforts to improve self-development capabilities of rural poverty-stricken areas and the poor population, and construction on 374,200 village-level public works projects was completed with government awards and subsidies, the launching of which were determined by villagers themselves.

Spending on energy conservation and environmental protection came to 199.843 billion yuan, 113% of the budgeted figure and an increase of 23.1%. Spending significantly exceeded the budgeted figure due to extra investment during budget implementation in the project to promote the use of energy-efficient products that benefit the people, as well as in improving the energy efficiency of buildings and laying sewers to complement urban sewage treatment facilities. Funds were spent on accelerating the construction of key energy conservation projects and improving the energy efficiency of 200 million square meters of residential buildings with central heating in northern China. A policy was introduced to promote sales of flat-screen televisions, air conditioners, refrigerators, washing machines, water heaters, and other highly-efficient, energy-saving products, which resulted in sales of such products totaling 32.74 million units for the year. We made funds available to support enterprises in adjusting their industrial structures, decommission outdated production facilities with a total capacity of 19.17 million tons in the coke industry and 59.69 million tons in the cement industry, and close down 5.45 million kilowatts of small thermal power stations. A total of 15,000 kilometers of sewers were built to complement urban sewage treatment systems; the living environment of 12,000 contiguous villages was improved; and ecological protection was strengthened in the key watersheds of the Huai, Hai, and Liao rivers and Tai, Chao, and Dianchi lakes. Key forestry projects were carried out, including one to protect virgin forests, and past achievements in returning cultivated land to forests and grazing land to grasslands were consolidated. Finally, funds were provided to promote the development of new energy and renewable energy as well as to develop a circular economy.

Expenditure on transportation totaled 396.922 billion yuan, 111.3% of the budgeted figure and an increase of 20.3%. The budgeted figure was exceeded largely due to an increase in investment in railway construction during the implementation of the budget. Comprehensive transportation capabilities were improved, national and provincial highways upgraded or expanded, inland waterways improved, and 194,000 kilometers of rural roads built or upgraded. We provided fuel subsidies for public transportation and other public service industries. We also granted subsidies to local governments for phasing out tolls on government-financed Grade II highways.

National defense spending was 650.603 billion yuan, 100% of the budgeted figure and an 11.5% increase. Funds were used to improve living and training conditions for our troops, support the military in promoting IT application, strengthen development of new- and high-technology weapons and equipment, and enhance the country's modern military capabilities.

Spending on public security reached 188 billion yuan, 102.9% of the budgeted figure and an increase of 10.9%. We improved the mechanism for ensuring funding for primary-level procuratorial, judicial, and public security departments to enhance their service capabilities and gave priority to supporting procuratorial, judicial, and public security departments in the central and western regions in clearing their debts arising from infrastructure building.

3) Central government tax rebates and transfer payments to local governments

Central government tax rebates and transfer payments to local governments totaled 4.538347 trillion yuan, 100.6% of the budgeted figure and an increase of 13.7%. This figure includes 2.147118 trillion yuan in general transfer payments and 1.879152 trillion yuan in special transfer payments. General transfer payments accounted for 53.3% of total transfer payments, an increase of 0.8 percentage points over 2011.

2. Implementation of Budgets for Government-managed Funds

In 2012, revenue of government-managed funds nationwide came to 3.751701 trillion yuan, while expenditure amounted to 3.606904 trillion yuan. Below is a breakdown of these figures.

Receipts of central government-managed funds totaled 331.344 billion yuan, 110.8% of the budgeted figure and an increase of 5.8%. Receipts exceeded the budgeted figure mainly because funds from the surcharge on electricity generated from renewable energy sources were included in last year's budget for the first time in accordance with the law, so as to support the development of these energy sources. Adding the 82.221 billion yuan carried forward from 2011, revenue of central government-managed funds totaled 413.565 billion yuan in 2012. Expenditure of central government-managed funds totaled 335.463 billion yuan, 88.1% of the budgeted figure and an increase of 8.1%. This total consists of 217.517 billion yuan of central government spending and 117.946 billion yuan in transfer payments to local governments. A total of 78.102 billion yuan from central government-managed funds was carried forward to 2013. The expenditure of central government-managed funds was less than the budgeted figure mainly because some projects were not implemented in 2012 due to insufficient preparatory work, while others were granted less funding in accordance with the principle of determining spending based on revenue.

Revenue of funds managed by local governments reached 3.420357 trillion yuan, a decrease of 10.5% mainly due to fewer receipts from the sale of state-owned land use rights. Adding the 117.946 billion yuan in transfer payments from central government-managed funds, the total revenue of local government-managed funds came to 3.538303 trillion yuan. Expenditure of local government-managed funds totaled 3.389387 trillion yuan, down 10.3%. This total includes 2.841819 trillion yuan of spending from the proceeds of selling state-owned land use rights. Surplus revenue from local government-managed funds was carried forward to 2013.

3. Implementation of Budgets for State Capital Operations

In 2012, revenue from state capital operations nationwide reached 157.284 billion yuan, and total expenditure reached 147.966 billion yuan. The following is a breakdown of these figures.

Revenue from state capital operations of the central government totaled 97.083 billion yuan, 115% of the budgeted figure and an increase of 26.9%. Revenue exceeded the budgeted figure mainly because the proportion of profits from state capital operations of tobacco enterprises collected by the central government was raised five percentage points and the economic returns of enterprises in some industries exceeded expectations in 2011 (revenue from state capital operations of state-owned enterprises is collected as a certain proportion of their profits for the previous year). Adding the 3.107 billion yuan carried forward from 2011, revenue totaled 100.19 billion yuan. Expenditure on the central government's state capital operations came to 92.979 billion yuan, 106.3% of the budgeted figure and an increase of 20.8%. This figure includes 5 billion yuan, up 25%, spent on social security and other areas related to improving quality of life as planned in last year's public finance budgets. Surplus revenue from the central government's state capital operations was used to shore up the capital bases of the five largest power corporations (China Huaneng Group, China Datang Corporation, China Huadian Corporation, China Guodian Corporation, and China Power Investment Corporation), details of which the State Council reported to the Standing Committee of the Eleventh NPC.

Revenue from local governments' state capital operations totaled 60.201 billion yuan, and total expenditure amounted to 54.987 billion yuan.

4. Implementation of the NPC Budget Resolution

In accordance with the relevant resolution of the Fifth Session of the Eleventh NPC, as well as the guidelines of the NPC Financial and Economic Affairs Commission, we strived to do better in public finance work.

First, we faithfully followed a proactive fiscal policy. We increased structural tax reductions and extended the pilot project to replace business tax with VAT from Shanghai to nine provinces and municipalities directly under the central government, including Beijing, and three cities specially designated in the state plan, thereby effectively promoting the development of the service sector and the optimization of the industrial structure and reducing the burden on enterprises. We raised VAT and business tax thresholds, and halved the corporate income tax on small businesses with low profits and expanded the scope of the policy to cover more businesses. Efforts were made to increase government subsidies, raise the income of low-income groups, and boost consumer spending. We improved the structure of government spending to direct more funding toward maintaining and improving quality of life and promote the development of education, health, social security, and other social programs. We better leveraged the role of fiscal and tax policies and worked to adjust the economic structure and balance regional development.

Second, we better ensured funding for county-level governments to perform their functions. We improved the mechanism for ensuring basic funding for governments at the county level, expanded its coverage, and increased the amount of funds guaranteed. The central government allocated a total of 107.5 billion yuan in awards and subsidies for this purpose, 30 billion yuan more than 2011, and provincial-level governments also carried out their responsibility in this regard, which basically made up the shortfall in funds for county-level governments and achieved the policy aim of ensuring these governments have sufficient funding to pay salaries, carry out normal operations, and safeguard the wellbeing of their residents.

Third, we strengthened management of local government debts. We further improved the system for managing local government debts, put them under standardized supervision, clarified who is responsible for repaying them, and saw to it that all local government bonds due in 2012 were redeemed on time. We also made notable progress in clearing debts of county-level governments.

Fourth, we pushed ahead with the work on releasing government budgets and final accounts. Relevant central government departments released their budgets and final accounts in accordance with relevant regulations. In addition to appropriations for spending on official overseas travel, official vehicles, and official hospitality disclosed in their 2011 final accounts and 2012 budgets, specific details regarding such expenditures were also made public. The information these departments provided was more meticulous, covered similar time periods, and was presented in a standardized form.

Fifth, we improved performance-based budget management. We worked hard to stress the importance of achieving results in the full course and every link of our budget management, formulated and promulgated a work plan for performance-based budget management, and made steady progress in carrying out pilot projects in this area. We also redoubled efforts to manage the implementation of budgetary expenditure, and implemented budgets more quickly. We tightened oversight of public finances, observed strict financial and economic discipline, and ensured smooth implementation of major policy decisions and plans of the central leadership.