Individual Income Tax Law of the People's Republic of China

Article 11 Where a resident individual obtains comprehensive income, his individual income tax shall be calculated on an annual basis. Where there is a withholding agent, the withholding agent shall withhold and prepay tax on a monthly basis or when the taxable income arises; where the annual tax reconciliation return is needed, it shall be filed within the period from March 1 to June 30 of the year following that in which the income was obtained. Regulation for withholding and prepayment shall be formulated by the department under the State Council responsible for tax administration.

Where a resident individual provides the withholding agent with information on his itemized deductions for specific expenditures, the withholding agent shall deduct relevant items from the resident individual's taxable income in accordance with regulations when making the monthly withholding and prepayment, and may not refuse the deduction.

Where a non-resident individual obtains income from salary or wages, remuneration for personal services, author's remuneration or royalties and where there is a withholding agent, the withholding agent shall withhold and pay tax on a monthly basis, or when taxable income arises. Annual tax reconciliation return shall not be required for that case.

Article 12 Where a taxpayer obtains income from business operation, the individual income tax shall be calculated on an annual basis. The taxpayer shall file the tax return for such income with the tax authority and prepay the tax within 15 days after the end of each month or quarter. The annual tax reconciliation return shall be filed by March 31 of the following year after obtaining the income.

Where a taxpayer obtains income from interest, dividends and bonuses, leasing of assets, transfer of assets or incidental income, the individual income tax shall be calculated on a monthly basis or when the taxable income arises. Where there is a withholding agent, the withholding agent shall withhold and pay tax on a monthly basis or as and when the taxable income arises.

Article 13 Where a taxpayer obtains taxable income but there is no withholding agent, the taxpayer shall file the tax return with the tax authority and pay tax by the 15th day of the month following that in which the income was obtained.

Where a taxpayer obtains taxable income and the withholding agent has failed to withhold and pay tax, the taxpayer shall pay the tax before June 30 of the year following that in which the income was obtained. Where a tax authority sets a time limit for the tax payment, the taxpayer shall pay within the allotted time.

Where a resident individual obtains income from overseas, he or she shall declare such income within the period from March 1 to June 30 of the year following that in which the income was obtained.

Where a non-resident individual obtains salary and wages from two or more sources within China, he shall declare such income by the 15th day of the month following that in which the income was obtained.

Where a taxpayer cancels the Chinese household registration as a result of emigration, he shall complete tax settlement and clearance before de-registration.

Article 14 Where tax is withheld by a withholding agent, whether on a monthly or transaction basis , it shall be turned over to the state treasury by the 15th day of the month following that in which it was withheld. The tax return for individual income tax withheld shall also be filed with the tax authority.

Where a taxpayer files an annual tax reconciliation in order to obtain a tax refund or where a withholding agent does so for the taxpayer, the tax authority shall deal with the tax refund after review and confirmation in accordance with the relevant regulations on administration of the state treasury.

Article 15 The public security authorities, the People's Bank of China, financial regulator and other relevant departments shall assist the tax authorities in verifying taxpayers' identities and information of their financial accounts. Departments of education, health, medical security, civil affairs, human resources and social security, housing and urban-rural development, public security, the People's Bank of China, financial regulator and other relevant departments shall provide tax authorities with information on itemized deductions for specific expenditures of taxpayers, including expenditures on their children's education, their own continuing education, medical treatment of a serious illness, housing loan interest or housing rent, and supporting the elderly.

For transfer of immovable property by individuals, the tax authorities shall verify the payable individual income tax based on relevant information such as the registration for the immovable property. Where a transfer of immovable property is being registered, the registration authority shall examine the certificate for payment of individual income tax on the transfer. Where a transfer of equity shares is being registered, the registration authority for market players shall examine the certificate for payment of individual income tax on the share transfer.

The relevant departments shall incorporate information on compliance with this Law by taxpayers and withholding agents into the credit information system in accordance with law, and implement joint incentives or sanctions.

Article 16 All forms of income shall be calculated in RMB. Where an income is paid in a foreign currency other than RMB, it shall be taxed after being converted into RMB based on central parity rate.

Article 17 A handling fee of 2 percent of the amount of tax withheld shall be paid to withholding agents.

Article 18 The levy, reduction and cessation of levying individual income tax on interest from saving deposits, as well as specific measures thereof, shall be stipulated by the State Council, and be submitted to the Standing Committee of National People's Congress for the record.

Article 19 Where a taxpayer, withholding agent or a tax authority or a staff member thereof, violates this Law, its legal liability shall be investigated in accordance with the Law of the People's Republic of China on the Administration of Tax Collection and other relevant provisions of laws and regulations.

Article 20 The administration of the collection of individual income tax shall be subject to provisions of this Law and the Law of the People's Republic of China on the Administration of Tax Collection.

Article 21 The State Council shall, pursuant to provisions of this Law, formulate regulations for its implementation.

Article 22 This Law shall go into effect from the date of its promulgation.

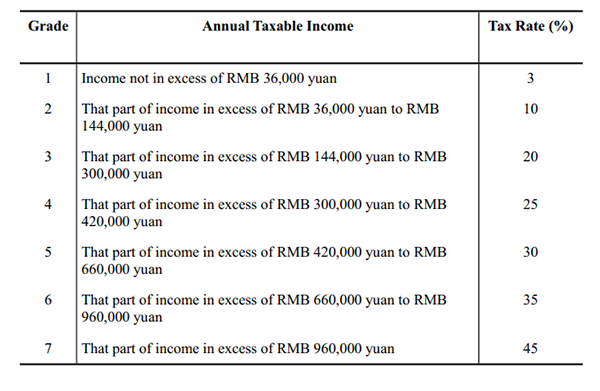

Schedule 1

Individual Income Tax Rates

(Applicable to Comprehensive Income)

(Note 1: Annual Taxable Income in this schedule refers to the amount of Comprehensive Income received by a resident individual in a tax year, after deduction of RMB 60,000 yuan, specific deductions, itemized deductions for specific expenditures and other deductible items determined by Law, in accordance with Article 6 of this Law.

Notes 2: For income received by a non-resident individual from salary and wages, remuneration for personal services, author's remuneration and royalties, the tax payable shall be calculated on a monthly basis as converted from this schedule.)

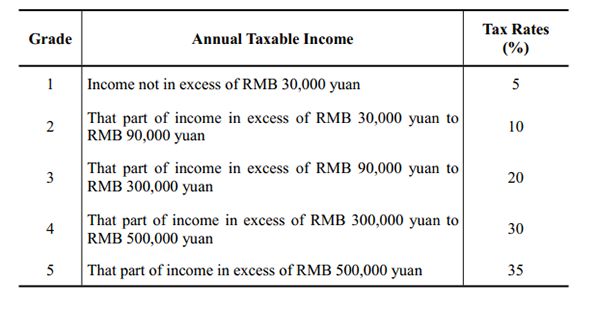

Schedule 2

Individual Income Tax Rates

(Applicable to Income from Business operation)

(Note: Annual Taxable Income in this schedule refers to the amount of income after deduction of costs, expenses and losses in a tax year, in accordance with Article 6 of this Law.)

- Top legislature schedules standing committee session for late February

- China's top legislator meets with Uruguayan president

- Senior legislator surveys Anhui on formulating outline of provincial 15th Five-Year Plan

- China's top legislator meets with British PM

- NPC deputies see more engagement with top court