Cultivated Land Occupation Tax Law of the People's Republic of China

Order of the President of the People's Republic of China

No. 18

The Cultivated land Occupation Tax Law of the People's Republic of Chinaadopted at the 7th Meeting of the Standing Committee of the Thirteenth National People's Congress on 29 December 2018 is hereby promulgated and shall go into effect as of 1 September 2019.

Xi Jinping

President of the People's Republic of China

December 29, 2018

Cultivated Land Occupation Tax Law of the People's Republic of China

(Adopted at the 7th Meeting of the Standing Committee of the Thirteenth National People's Congress on 29 December 2018)

Article 1 This Law is formulated in order to reasonably utilize land resources, strengthen land administration and protect cultivated land.

Article 2 Any unit or individual that occupies cultivated land to construct buildings or structures or engage in non-agricultural construction within the territory of the People's Republic of China is the taxpayer of cultivated land occupation tax who shall pay cultivated land occupation tax in accordance with the provisions of this Law.

Those that occupy cultivated land for building cultivated land water conservancy facilities shall not be required to pay cultivated land occupation tax.

For the purpose of this Law, "cultivated land" refers to the land used for growing crops.

Article 3 Cultivated land occupation tax shall be calculated on the basis of the area of the cultivated land actually occupied by the taxpayer and the levy shall be one-off at the applicable tax rate as prescribed. The tax amount payable shall be the area of cultivated land (square meter) actually occupied by the taxpayer multiplied by the applicable tax rate.

Article 4 The rates of cultivated land occupation tax are as follows:

(1) For the regions (counties, autonomous counties, non-districted cities or municipal districts, the same hereinafter) where the per capita cultivated land is not more than 1 mu, the rate is 10-50 yuan per square meter;

(2) For the regions where the per capita cultivated land exceeds 1 mu but is not more than 2 mu, the rate is 8-40 yuan per square meter;

(3) For the regions where the per capita cultivated land exceeds 2 mu but is not more than 3 mu, the rate is 6-30 yuan per square meter; and

(4) For the regions where the per capita cultivated land is more than 3 mu, the rate is 5-25 yuan per square meter.

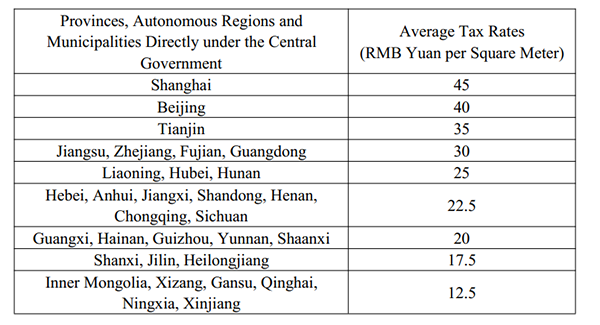

The applicable rates of cultivated land occupation tax for different regions shall be proposed by the people's government of each province, autonomous region and municipality directly under the Central Government within the ranges as specified in the preceding paragraph in light of the per capita cultivated land, the economic development and other conditions, and shall be submitted to the standing committee of the people's congress at the same level for decision, and then be submitted to the Standing Committee of the National People's Congress and the State Council for the record. The average level of cultivated land occupation tax rate applicable in each province, autonomous region or municipality directly under the Central Government shall not be lower than the average tax rate as prescribed in the Table of Average Rates of Cultivated land Occupation Tax for Provinces, Autonomous Regions and Municipalities directly under the Central Government as attached hereto.

Article 5 For the regions where the per capita cultivated land is less than 0.5 mu, provinces, autonomous regions and municipalities directly under the Central Government may, in light of the local economic development, appropriately raise the applicable rates of cultivated land occupation tax, provided that such increase shall not exceed 50% of the applicable tax rates specified in the second paragraph of Article 4 of this Law. The specific applicable tax rates shall be determined under the procedures prescribed in the second paragraph of Article 4 of this Law.

Article 6 Any unit or individual that occupies basic cultivated land shall pay the tax at a rate of 150% of the local applicable tax rates determined in accordance with the second paragraph of Article 4 or Article 5 of this Law.

Article 7 Cultivated land occupied by military facilities, schools, kindergartens, social welfare institutions and medical institutions shall be exempt from cultivated land occupation tax.

Cultivated land occupied by railway lines, highway lines, airport runways, airport aprons, ports, waterways and water conservancy projects shall be subject to cultivated land occupation tax at the reduced rate of two yuan per square meter.

If rural residents occupy cultivated land to build new houses for own use within the prescribed land use standards, cultivated land occupation tax shall be levied at half of the local applicable tax rates; specifically, if a rural resident is approved to relocate and the part of the cultivated land occupied for the newly-built house for own use does not exceed the area of the original house site, the rural resident shall be exempt from cultivated land occupation tax.

The dependents of rural martyrs, the dependents of the servicemen who perished in the line of duty, the disabled servicemen and the rural residents that meet the conditions for minimum living allowance in rural areas shall be exempt from cultivated land occupation tax on the newly built houses for their own use within the prescribed land use standards.

According to the national economic and social development needs, the State Council may stipulate other circumstances for exemption or reduction of cultivated land occupation tax, and submit them to the Standing Committee of the National People's Congress for the record.

Article 8 After the exemption or reduction of cultivated land occupation tax in accordance with the provisions of the first or second paragraph of Article 7 of this Law, if the taxpayer changes the original purpose of land occupation, which is no longer qualified for exemption or reduction of cultivated land occupation tax, the taxpayer shall make a supplementary payment for cultivated land occupation tax at the local applicable tax rate.

Article 9 Cultivated land occupancy tax shall be collected by tax authorities.

Article 10 The time when the obligation to pay the cultivated land occupation tax occurs shall be the day when the taxpayer receives a written notice from the competent department of natural resources for going through formalities for cultivated land occupation. The taxpayer shall file a tax return and pay cultivated land occupation tax within 30 days from the date of occurrence of tax obligation.

The competent department of natural resources shall issue the Approval for Construction Land on the basis of cultivated land occupation tax payment certificate or tax exemption certificate, and other relevant documents.

Article 11 The taxpayer who temporarily occupies cultivated land for construction projects or geological survey, shall pay cultivated land occupation tax in accordance with the provisions of this Law. If the taxpayer reclaims land according to law within one year after the expiration of the period of approval of temporary occupation of cultivated land and restores planting conditions, the cultivated land occupation tax already paid shall be refunded in full.

Article 12 Any unit or individual that occupies garden plots, woodland, grassland, land for cultivated land water conservancy, water surfaces for breeding aquatics, tidal flat in a fishing water area and other agricultural land to construct buildings or structures or engage in non-agricultural constructions shall pay cultivated land occupation tax in accordance with the provisions of this Law.

Where the agricultural land specified in the preceding paragraph is occupied, the applicable tax rates may be appropriately lower than the local applicable tax rates determined in accordance with the second paragraph of Article 4 of this Law, provided that the reduced rates shall not be less than 50% of the local applicable rates. The specific applicable tax rates shall be proposed by the people's government of each province, autonomous region or municipality directly under the Central Government and submitted to the standing committee of the people's congress at the same level for decision and then be submitted to the Standing Committee of the National People's Congress and the State Council for the record.

Any unit or individual that occupies the agricultural land prescribed in the first paragraph of this Article for the construction of production facilities to directly serve agricultural production shall be exempt from cultivated land occupation tax.

Article 13 Tax authorities shall, in conjunction with relevant departments, establish tax-related information sharing mechanism and work coordination mechanism for cultivated land occupation tax. Departments of natural resources, agriculture and rural affairs, water resources and other departments of the local people's government at or above the county level shall regularly provide tax authorities with information on the conversion of agricultural land and temporary land occupation, etc. and assist tax authorities in strengthening the administration of the collection of cultivated land occupation tax.

If a tax authority discovers any abnormality in the data of a taxpayer's tax return or that a taxpayer fails to file a tax return within the prescribed time limit, it may request the relevant departments to conduct a review. The relevant departments shall issue review conclusions to tax authorities within 30 days from the date of the receipt of the application for review from the tax authority.

Article 14 The administration of the collection of cultivated land occupation tax shall be carried out in accordance with the provisions of this Law and the Law of the People's Republic of China on the Administration of Tax Collection.

Article 15 Where taxpayers, tax authorities and their staff violate the provisions of this Law, their legal liabilities shall be investigated in accordance with the Law of the People's Republic of China on the Administration of Tax Collection and other relevant provisions of laws and regulations.

Article 16 This Law shall go into effect as of 1 September 2019. The Provisional Regulations on Cultivated Land Occupation Tax of the People's Republic of China promulgated by the State Council on 1 December, 2007 shall be repealed simultaneously.

Annex:

Average Cultivated Land Occupation Tax Rates of Provinces, Autonomous Regions and Municipalities Directly under the Central Government

- Top legislature schedules standing committee session for late February

- China's top legislator meets with Uruguayan president

- Senior legislator surveys Anhui on formulating outline of provincial 15th Five-Year Plan

- China's top legislator meets with British PM

- NPC deputies see more engagement with top court